EMA product updates - 14th Feb

PharmaFootpath currently shares details on the latest EMA product registration updates through Linkedin, but will start to share through a newsletter too. As subscribers to our company updates, I've added you here too, but feel free to unsubsribe to this newsletter if not relevant, it won't affect receiving the company updates!

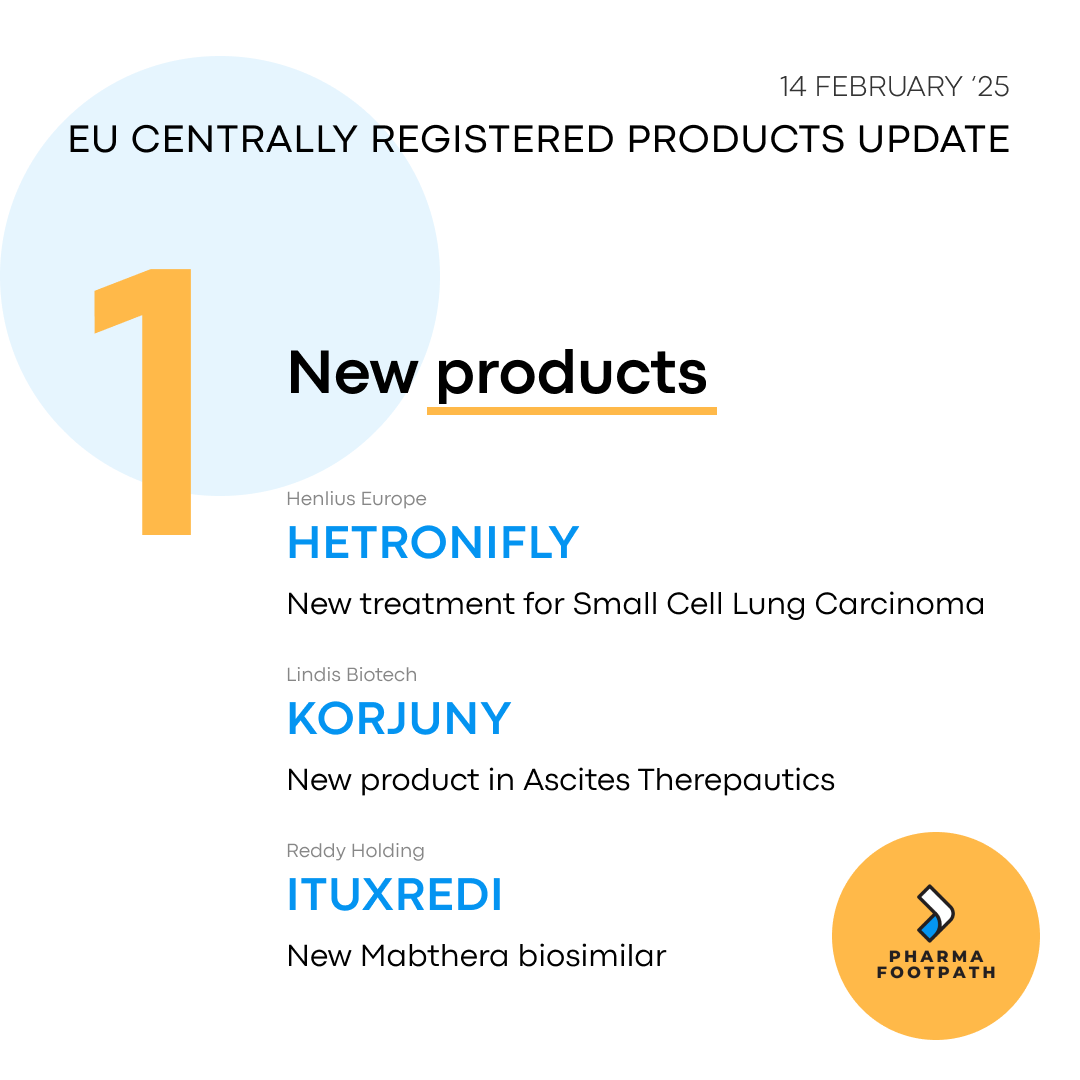

Three new products have had marketing authorisation approved, with two new novel products, and the latest Mabthera biosimilar to be launched. Dr.Reddys have added Ituxredi to their portfolio, looking to capture a share of the large Rituximab market.

Jakavi has been a hugelly successful product from Novartis, who have now launched an oral solution presentation for the first time.

Kinpeygo had 4 different pack sizes of the same strength product, they've withdrawn the pack size 100, but the 28, 120 and 360 remain unaffected and continue to be authorised with the EMA

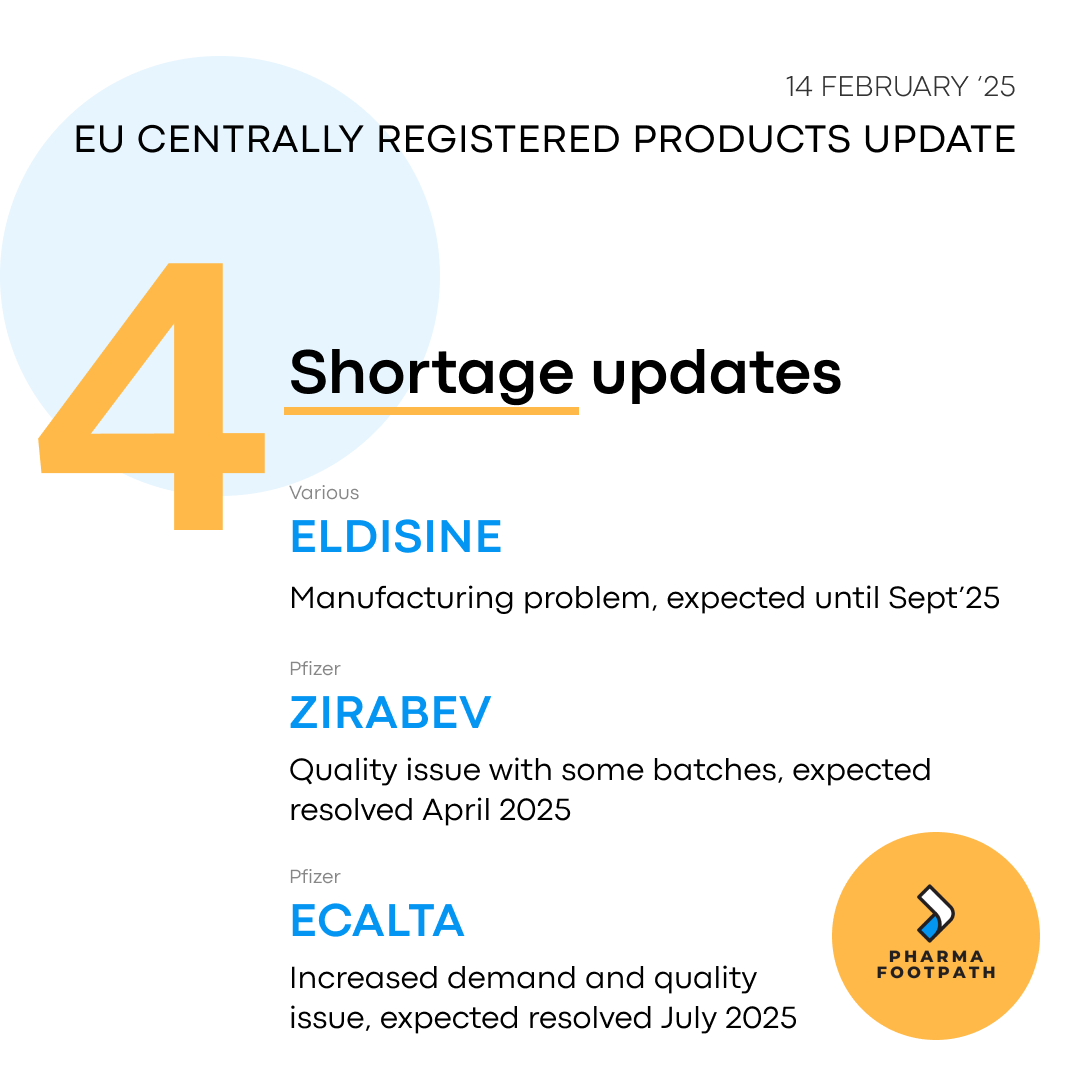

Eldisine is not a centrally registered product, but it's manufacturing challenges affect numerous markets so it is provided as a shortage at the EMA. The reason for shortage is a new manufacturing process being implemented to produce Vindesine, the product API, which is expected to be implemented and providing new stock in September 2025

Both Zirabev and Ecalta had batches produced with quality issues that were all destroyed before reaching the market, resulting in a gap in production plan. Shortages are expected, but may not affect all markets equally.

This is a new newsletter, so please share it with anyone you think would benefit from it. They can sign up using the footer below!

Phil

P.S. Please feel free to email suggestions for improvement too!